Anti-Fragile: How Israeli Tech Thrived Amidst Uncertainty in H1 2025

Yanai Oron09 Sept 2025

When people ask me to explain what's happening in Israeli tech right now, I often think of Nassim Taleb's concept of "anti-fragile." It's not just about being strong versus weak—it's about actually growing stronger through adversity. That's exactly what we've witnessed in the first half of 2025, and frankly, the numbers speak louder than any theory.

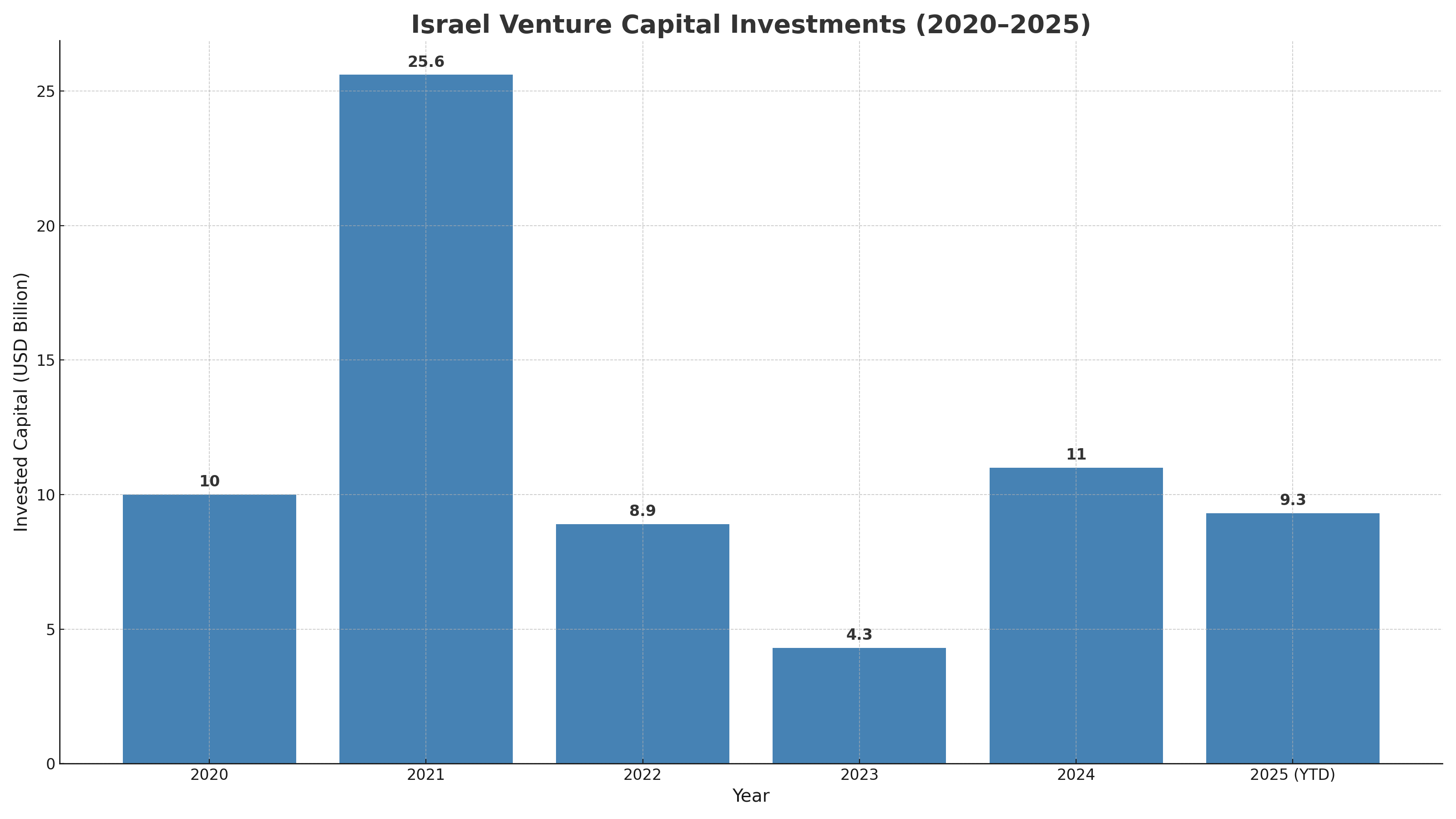

Israeli tech companies raised an astounding $9.3 billion in H1 2025¹, marking the strongest six-month performance we've seen in three years. This represents a 54% jump from the second half of 2024, and what makes it even more remarkable is the context: we're operating in a region still grappling with ongoing conflict, yet international capital is flooding in at unprecedented levels.

The Smart Money Knows Something

The most telling indicator isn't just the volume of investment—it's who's writing the checks. We're seeing Silicon Valley's most sophisticated investors not just maintaining their presence in Israel, but actually doubling down. Sequoia, Index, and Greylock have all hired local Israeli partners. These aren't charitable gestures or political statements; these are calculated business decisions by funds that manage billions of dollars.

I've been in conversations with some of these investors, and what they tell me is consistent: their Israeli portfolio companies are performing as well as, if not better than, their pre-conflict benchmarks. When smart money sees performance holding steady despite external chaos, they recognize an opportunity that others might miss.

The economic fundamentals support this confidence. Israel's stock market is up 70% from the day before the October 7th attack, and the Israeli shekel has strengthened more than 10% against the dollar. What's particularly interesting is that the Tel Aviv 35 exchange—which represents our broader economy—includes only one tech company among its 35 constituents. This tells us that Israel's economic resilience extends far beyond our tech sector.

Exit Velocity: When Validation Meets Valuation

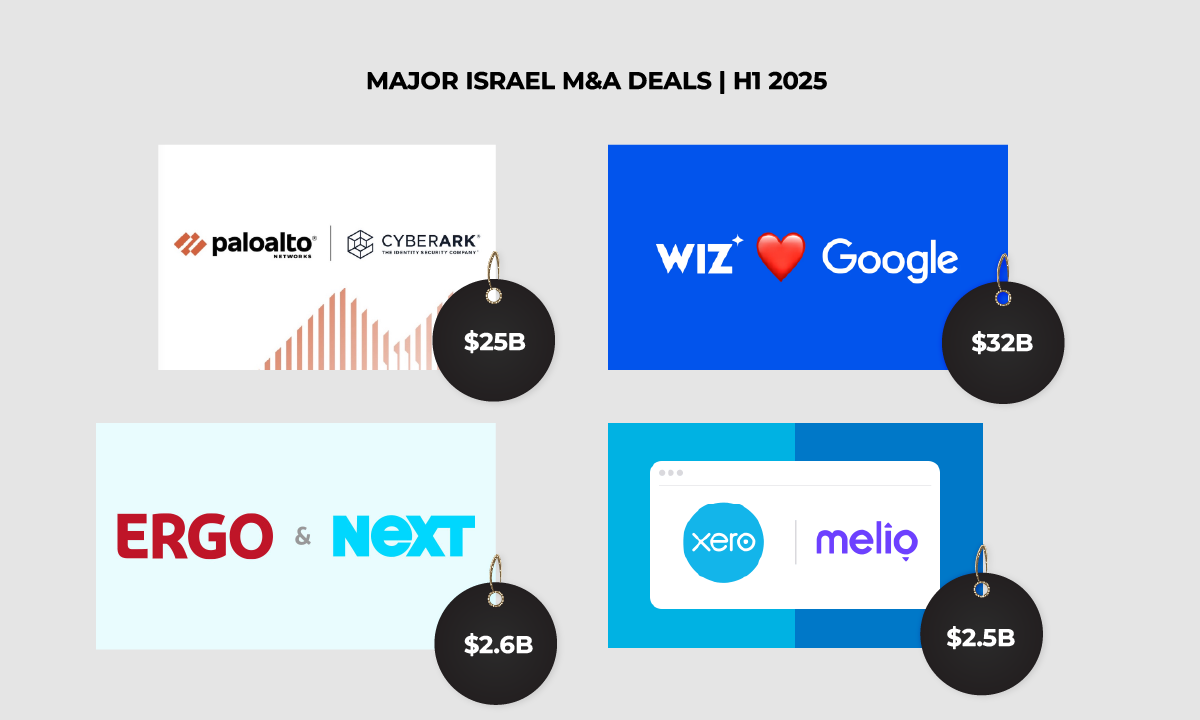

The exit landscape in 2025 has been nothing short of spectacular. We've seen three major deals that collectively represent over $37 billion in transaction value: Wiz's pending $32 billion acquisition by Google, CyberArk's $25 billion sale to Palo Alto Networks, and a series of other significant exits including Next Insurance ($2.6 billion to Munich Re) and Melio ($2.5 billion to Xero)².

What's fascinating about the Melio deal is the story behind it. The final closing happened during the 12-day conflict with Iran, involving a New Zealand company that had no previous Israeli presence and needed to raise Australian debt to complete the acquisition. When a company from the other side of the world is willing to navigate complex financing during a regional crisis to acquire an Israeli startup, you know the value proposition is compelling.

At Vertex, we've been particularly proud of our own exits. Our portfolio company Own, which provides enterprise backup solutions, was acquired by Salesforce for $1.9 billion. These aren't just cyber companies—though cyber remains a core strength—but span enterprise software, fintech, and beyond.

The premiums being paid tell a crucial story about buyer appetite. Acquirers aren't just buying technology; they're buying access to the most attractive market in the world: the United States. Ninety-nine percent of Israeli companies start by selling to the US market first, which makes them immediately attractive to international buyers looking to expand their American footprint.

Battle-Tested Innovation

The conflict has created an unexpected catalyst for innovation. About half of the defense companies that have raised significant funding recently—from funds like Lux, Sequoia, General Catalyst, and Founders Fund—are actually dual-use technologies with strong civilian applications.

Take our portfolio company D-fend, which develops anti-drone technology. Rather than shooting down drones, they use cyber methods to sense and take control of these devices, landing them safely. While they do sell to militaries, most of their revenue comes from civilian infrastructure—stadiums, airports, critical facilities—that need protection from potential drone threats. They're already generating tens of millions in revenue this year.

This trend represents something larger than just defense tech. The conflict has forced entrepreneurs to think creatively about solutions to real-world problems, often leading to innovations that have broad commercial applications. Many of these founders met during reserve service, exchanging ideas and returning with a renewed sense of purpose and urgency about building meaningful technology.

The Wartime CEO Phenomenon

From my conversations with founders across our portfolio, I've observed something remarkable: the emergence of what I call "wartime CEOs." These entrepreneurs have navigated not just the regional conflict, but a perfect storm of challenges over the past four to five years—COVID-19, the AI revolution threatening existing business models, and now wartime conditions.

This crucible has forged some of the most resilient and capable leaders I've encountered in my career. There are no excuses in this environment—before your next funding round, you simply must show the right metrics. Investors aren't giving anyone breaks based on external circumstances. The founders who have survived and thrived through this period have developed an extraordinary capacity for adaptation and execution.

The day-to-day reality is more mundane than you might expect. Most of the time, workers are in the office, business operates normally. During particularly intense periods—like the recent 12-day conflict with Iran—teams work more from home, productivity might dip slightly, but operations continue. What's remarkable is that when we look at our portfolio companies' quarter-over-quarter performance, there's no meaningful difference from pre-conflict levels.

In July alone, five of our companies finalized funding rounds, with four of the five led by foreign investors. This happened mostly during the Iran conflict period, demonstrating that international investors view these as normal business decisions rather than geopolitical risks.

Capital Flow Patterns

The funding landscape reveals interesting patterns about international confidence. More than 70-80% of capital flowing into Israeli startups comes from foreign funds³, a trend that has accelerated rather than reversed during the conflict period. Multi-stage funds have been particularly active, often leading multiple rounds across our ecosystem.

Foreign VCs aren't just participating—they're competing aggressively for deals. I recently spoke with one of our founders who received a $100 million term sheet at a 2x valuation increase. These aren't distressed asset purchases; these are growth investments based on fundamental business performance.

Looking Forward: Momentum Continues

When I spoke with one of Israel's prominent investment bankers recently, he mentioned having more than 11 mandates for acquisitions and IPOs in the pipeline. Navan, an Israeli expense management company, is reportedly planning to raise funds at a valuation between $7-10 billion⁴. The signals all point toward continued momentum.

The first half of 2025 has already surpassed 2024's full-year investment totals by some measures, with estimates suggesting we've seen over $7 billion invested—representing a 30-40% increase over the previous year's pace. While it's difficult to forecast exact numbers due to the impact of mega-deals, I see no structural reasons for this momentum to slow.

The Anti-Fragile Advantage

What we're witnessing in Israeli tech goes beyond mere resilience. The combination of battle-tested innovation, access to the world's largest market, proven execution under pressure, and now international validation through massive capital inflows has created a unique value proposition.

The concept of anti-fragility perfectly captures what's happening here. Rather than simply weathering the storm, Israeli tech has used adversity as a catalyst for innovation, operational excellence, and market expansion. The smart money recognizes this dynamic, which is why we're seeing record levels of investment and exits despite—or perhaps because of—the challenging operating environment.

As we move into the second half of 2025, all indicators suggest this trend will continue. The combination of strong fundamentals, proven resilience, and international validation has created a momentum that transcends regional geopolitics. For Israeli tech, the paradox of thriving amid instability isn't really a paradox at all—it's simply what happens when innovation meets necessity, and both are backed by world-class execution.

Sources:* ¹ Based on interview data and industry reports ² Exit valuations cited from public announcements and industry sources ³ Foreign investment percentages based on Vertex Ventures Israel internal analysis ⁴ Navan valuation reports from financial media coverage

This article is based on an interview conducted in August 2025 with Yanai Oron, General Partner at Vertex Ventures Israel.

/f/233941/1200x720/f2230a8e1b/yanai-thumb.png)